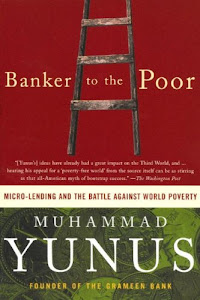

Banker to the Poor: Micro-lending and the Battle Against World Poverty

Catégorie: Fantasy et Terreur, Histoire

Auteur: Véronique Enginger, Steve Collings

Éditeur: Timothy Snyder

Publié: 2017-04-26

Écrivain: Zach Klein

Langue: Portugais, Hébreu, Breton, Russe

Format: pdf, epub

Auteur: Véronique Enginger, Steve Collings

Éditeur: Timothy Snyder

Publié: 2017-04-26

Écrivain: Zach Klein

Langue: Portugais, Hébreu, Breton, Russe

Format: pdf, epub

Startups News - The Business Journals - · The Business Journals features local business news from 43 different cities across the nation. We also provide tools to help businesses grow, network and hire

Microcredit - Wikipedia - This article is specific to small loans, often provided in a pooled manner. For direct payments to individuals for specific projects, see financial services to the poor, see small payments, see Micropayment.. Microcredit is the extension of very small loans (microloans) to impoverished borrowers who typically lack collateral, steady employment, or a

Top 10 Poverty Quotes from Famous Humanitarians - · After the World Summit on Social Development in Copenhagen in 1995, ... They were poor because the financial institution in the country did not help them widen their economic base.” — Muhammad Yunus, Author of “Banker to the Poor: Micro-Lending and the Battle against World Poverty.” “Where you live should not determine whether you live, or whether you die.” — Bono, Singer …

3.2 Corporate Social Responsibility and Social - We cannot accurately measure success within a quarter of a year; a longer time is often required for a product or service to find its market and gain traction against competitors, or for the effects of a new business policy to be felt. Satisfying consumers’ demands, going green, being socially responsible, and acting above and beyond the basic requirements all take time and money. However

Muhammad Yunus - Wikipedia, la enciclopedia libre - Muhammad Yunus (bengalí: মুহাম্মদ ইউনুস, pronunciado Muhammôd Iunūs) (Chittagong, 28 de junio de 1940), es un emprendedor social, banquero, economista y líder social bangladesí condecorado con el Premio Nobel de la Paz por desarrollar el Banco Grameen y ser el desarrollador de los conceptos de microcrédito, (ideado por el pakistaní Dr. Akhter Hameed Khan), y

Best Economics Books (372 books) - Goodreads - 372 books based on 526 votes: An Inquiry into the Nature and Causes of the Wealth of Nations by Adam Smith, Das Kapital by Karl Marx, The Road to

183 Poverty Topic Ideas to Write about & Essay Samples - · Banker to the Poor: Micro-Lending and the Battle against World Poverty: Advantages of Microcredit . The main features of the Grameen project are the availability to the poor people who have no credit history and are not able to borrow a loan from a bank because of the lack of […] Poverty in Russia during the Late Nineteenth Century. Most importantly, Pytor Pertovich Semyonova role was

Development Quotes (831 quotes) - Goodreads - “People.. were poor not because they were stupid or lazy. They worked all day long, doing complex physical tasks. They were poor because the financial institution in the country did not help them widen their economic base.” ― Muhammad Yunus, Banker to the Poor: Micro-Lending and the Battle Against World Poverty

Muhammad Yunus - Wikipedia - Muhammad Yunus (born 28 June 1940) is a Bangladeshi social entrepreneur, banker, economist and civil society leader who was awarded the Nobel Peace Prize for founding the Grameen Bank and pioneering the concepts of microcredit and microfinance. These loans are given to entrepreneurs too poor to qualify for traditional bank loans. Yunus and the Grameen Bank were jointly awarded the …

Buy Insurance Policy Online | Renew Insurance - It provides some definite method for raising these funds by levies against the units covered by the scheme. Wherever there is accumulation for uncertain losses, or wherever there is transfer of risk, there is one element of Insurance, only when these are joined with the combination of risk in a group is the Insurance complete. Another way to state this is to say that “Insurance is a transfer

[goodreads], [free], [pdf], [english], [online], [epub], [audiobook], [kindle], [audible], [read], [download]

0 komentar:

Posting Komentar

Catatan: Hanya anggota dari blog ini yang dapat mengirim komentar.